I bet if I asked you “What is the best Forex indicator ever?” you’d scream “RSI”, “MACD” or “SMA” just like every other beginner trader would. In forex trading, opinions vary among traders regarding the best indicators to employ. Some say it’s the Moving Average Convergence Divergence (MACD) for identifying trend reversals and generating trading signals, others say it is the Relative Strength Index (RSI), which measures the momentum of price movements and helps determine overbought or oversold conditions. But what most people seem to overlook, is the most important indicator of all - “Price”.

Price is the most reliable indicator in trading, it carries a wealth of information that can guide traders in making informed decisions. It’s a universal language understood by all traders across different markets and timeframes. Whether one is trading stocks, commodities, or forex, the principles of price action analysis remain applicable. This universality makes price a powerful tool for traders, as the same principles can be effectively applied across various markets and instruments.

Why price is important?

Price movements reflect the collective actions of market participants, including their fear, greed, and expectations. By observing price patterns and analyzing the behavior of buyers and sellers, traders can gain insights into market sentiment, which can be a valuable guide in making trading decisions. For instance, during times of uncertainty or major news events, price often reacts with increased volatility and erratic movements. Traders can interpret such price behavior as heightened market emotions and adjust their strategies accordingly.

Unlike other indicators that rely on complex calculations or subjective interpretations, price is a direct reflection of market supply and demand dynamics. It is free from the biases or assumptions inherent in many indicator formulas, making it an unbiased and transparent measure of market sentiment.

Another crucial aspect of price as the best trading indicator is its real-time nature. Price movements occur instantaneously and provide traders with immediate feedback on market conditions. Unlike lagging indicators that rely on historical data and may generate delayed signals, price allows traders to react quickly to market changes.

Price also exhibits inherent versatility across different markets and timeframes. The principles of price analysis are applicable to any financial instrument, whether it's stocks, commodities, forex, or cryptocurrencies, and also various timeframes, short-term, intraday trading to long-term investing. The universality and adaptability of price analysis make it a powerful tool for traders across different markets and trading styles.

Some price actions you should know:

Price action analysis allows traders to develop a deep understanding of the market they are trading. By immersing themselves in price movements and studying historical price patterns, traders can become familiar with the nuances and characteristics of the market. This familiarity enhances their ability to identify high-probability trading opportunities and make more accurate predictions about future price movements.

Here are some important price actions you should know:

Support and Resistance:

One of the fundamental concepts in price action analysis is support and resistance levels. Support represents a price level where buying interest is expected to emerge, preventing further price declines. Resistance, on the other hand, denotes a price level where selling pressure typically arises, halting upward price movement.

Identifying support and resistance levels provides traders with valuable information about potential entry and exit points. When the price approaches a support level, traders often look for bullish signals, such as price rejection or bullish candlestick patterns, indicating a potential buying opportunity. Conversely, when the price nears a resistance level, bearish signals may suggest a potential selling opportunity. This approach enables traders to capitalize on predictable price reactions at critical levels.

Breakout:

A breakout occurs when the price of an asset moves beyond a significant level of support or resistance, typically accompanied by increased volume and volatility.

Breakouts can signify the start of a new trend or the continuation of an existing one. When the price breaks above a resistance level, it suggests increased buying pressure and a potential upward trend.

Conversely, a breakout below a support level indicates heightened selling pressure and the possibility of a downward trend.

Traders employ various strategies to identify and trade breakouts effectively. They often look for consolidation patterns, such as triangles, flags, or rectangles, which precede breakouts.

Trend lines:

Trendlines are a fundamental price trading indicator widely used by traders to identify and analyze trends in financial markets. A trendline is a straight line drawn on a price chart that connects two or more significant points, such as higher lows in an uptrend or lower highs in a downtrend.

Traders analyze the slope and validity of trend lines to assess the strength of the trend and potential reversal points. An upward trendline indicates a bullish trend, suggesting that buyers are in control, while a downward trendline represents a bearish trend, indicating selling pressure.

Price Consolidation:

Price consolidation refers to periods when the price of an asset trades within a defined range with relatively little directional movement. Traders often look for breakouts or breakdowns from these consolidation phases to identify potential trading opportunities.

Price Reversals:

Price reversals occur when the price changes direction, often after reaching a significant support or resistance level or forming a specific pattern. Traders analyze price action to identify signs of a potential reversal, such as trend exhaustion, divergences, or the failure of the price to break key levels.

Price Volatility:

Price volatility refers to the magnitude and frequency of price fluctuations. Traders may use volatility analysis to assess market conditions, set appropriate stop-loss levels, or identify potential trading opportunities during periods of high volatility.

These are just a few examples of chart price actions that traders observe and analyze. Understanding price action can help traders make more informed decisions based on the behavior of price itself rather than relying solely on indicators or other technical tools.

Chart patterns

Chart patterns also play a crucial role in price action analysis. By analyzing chart patterns, trends, and key levels, traders can gain valuable insights into market behavior and potential future price movements. For example, a bullish trend may exhibit a series of higher highs and higher lows. By recognizing this pattern, traders can anticipate further upward price movement and look for opportunities to enter long positions.

Similarly, a bearish trend characterized by lower highs and lower lows can guide traders in identifying potential shorting opportunities. The ability to analyze chart patterns empowers traders to make well-timed and profitable trading decisions. Let us take a look at some common price patterns that can be seen in our charts.

Trend patterns:

Trend patterns are crucial in technical analysis as they help traders identify the overall direction of price movements. Here are the three main types of trend patterns:

Uptrend:

An uptrend is characterized by a series of higher highs and higher lows. Here, the price consistently moves upward over an extended period. Traders often view uptrends as bullish signals, indicating an overall positive sentiment in the market.

In an uptrend, each subsequent high is higher than the previous high, demonstrating the increasing strength of buyers. The higher lows signify that, even during temporary pullbacks or corrections, buyers are stepping in at higher price levels, indicating their willingness to support the upward price movement. Traders who identify an uptrend may look for opportunities to enter long positions (buying) in anticipation of further price appreciation. Various technical analysis tools, such as moving averages, trendlines, or momentum indicators are used to confirm an uptrend.

Downtrend:

A downtrend is characterized by a series of lower highs and lower lows. The price consistently moves downward over an extended period, indicating a negative sentiment in the market. Downtrends can occur due to factors such as selling pressure, negative news, weak fundamentals, or a shift in market sentiment toward pessimism.

In a downtrend, each subsequent high is lower than the previous high, indicating increasing strength among sellers. The lower lows suggest that, even during temporary price bounces or corrective rallies, sellers are willing to step in at lower price levels, further driving the price downward. Traders who identify a downtrend may consider short positions (selling) in anticipation of further price declines. They may use technical analysis tools, such as moving averages, trendlines, or oscillators, to confirm the downtrend and identify potential entry and exit points.

Sideways Trend:

A sideways trend, also known as a range-bound market, occurs when the price moves within a horizontal range without displaying a clear upward or downward direction. In this pattern, the price oscillates between established levels of support and resistance. Traders often observe a period of consolidation, with the price bouncing between these levels without making significant progress in either direction.

Sideway trends can occur when the market lacks a clear catalyst or when buyers and sellers are relatively balanced in terms of their influence on price movements. Traders may view sideways trends as periods of indecision or market uncertainty.

During a sideways trend, traders may employ range-based trading strategies, buying near support levels and selling near resistance levels. They may also use oscillators, such as the Relative Strength Index (RSI) or Stochastic Oscillator, to identify overbought and oversold conditions within the range.

Reversal Patterns:

Head and Shoulders:

A pattern with three peaks, where the middle peak (the head) is higher than the other two (the shoulders). It suggests a potential trend reversal from bullish to bearish. This pattern is typically observed at the end of an uptrend and indicates a potential shift from bullish to bearish sentiment. Connecting the lows between the peaks forms a neckline, which acts as a support level. The neckline is typically a horizontal line, although it can also have a slight upward or downward slope. The neckline is a crucial component of the pattern, and its breach is considered a significant confirmation of the pattern.

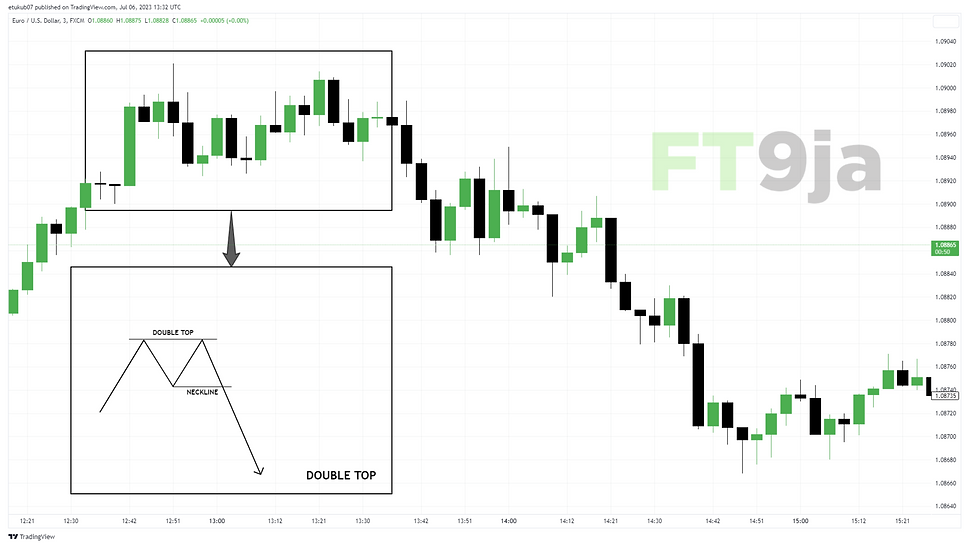

Double Top/Bottom:

The double top and double bottom patterns are well-known chart patterns that can indicate potential trend reversals in financial markets. These patterns are formed by two consecutive peaks (double top) or two consecutive troughs (double bottom) at approximately the same price level. They signify a shift in sentiment from bullish to bearish (double top) or from bearish to bullish (double bottom).

Triple Top/Bottom

Similar to double top/bottom, but while the double top/bottom consists of two consecutive peaks or troughs, the triple top/bottom involves three successive tops or bottoms around the same price level, suggesting an even stronger reversal.

Continuation Patterns:

Flag:

The flag pattern is a continuation pattern commonly observed in technical analysis. It represents a temporary pause or consolidation within an ongoing trend before the price resumes its previous direction. The pattern is named "flag" due to its resemblance to a flagpole with a flag fluttering in the wind.

The duration of the flag pattern can vary. It may last from a few days to several weeks, depending on the timeframe being analyzed.

The flag pattern is considered confirmed when the price breaks out of the flag formation and resumes its prior trend. In a bullish flag, the breakout occurs to the upside, indicating a continuation of the preceding uptrend. In a bearish flag, the breakout occurs to the downside, indicating a continuation of the preceding downtrend.

Pennant:

Similar to a flag, the pennant pattern is a short-term continuation pattern commonly observed in technical analysis. It resembles a small symmetrical triangle or flag and signifies a temporary pause or consolidation in the price before the resumption of the previous trend.

Triangle:

The triangle pattern is a common chart pattern in technical analysis that represents a period of consolidation and indecision in the market. It is formed by converging trendlines that connect the higher lows and lower highs on a price chart, creating a triangular shape. The triangle pattern indicates a potential breakout and subsequent continuation or reversal of the prior trend.

There are three primary types of triangle patterns:

Ascending Triangle:

This pattern is characterized by a horizontal resistance line and an ascending trendline. The price creates higher lows but struggles to break above the horizontal resistance level. It suggests that buying pressure is gradually increasing and may eventually result in a bullish breakout.

Descending Triangle:

In contrast to the ascending triangle, the descending triangle features a horizontal support line and a descending trendline. The price forms lower highs but finds support at the horizontal level. It indicates that selling pressure is gradually increasing and may potentially lead to a bearish breakout.

Symmetrical Triangle:

The symmetrical triangle pattern is formed when the trendlines converge, creating a symmetrical shape. Both the support and resistance lines slope towards each other. This pattern suggests a period of indecision, as buyers and sellers are in balance. It typically precedes a significant breakout in either direction, indicating a potential trend continuation or reversal.

Candlestick Patterns:

Doji:

The Doji candlestick pattern is a significant and widely recognized pattern in Japanese candlestick charting. It is characterized by a candlestick with a small body, indicating that the opening and closing prices are very close to each other or even identical. The Doji pattern reflects market indecision between buyers and sellers and often signals a potential reversal or continuation of the current trend. There are different variations of the Doji pattern based on the position of the open and close prices within the candlestick. These include:

Standard Doji: The open and close prices are virtually the same.

Long-Legged Doji: The upper and lower shadows are relatively long compared to the small body.

Dragonfly Doji: The open, high, and close prices are at the high of the session, with no upper shadow.

Gravestone Doji: The open, low, and close prices are at the low of the session, with no lower shadow.

Engulfing:

The Engulfing candlestick pattern is a powerful reversal pattern commonly used in technical analysis. It occurs when a smaller candlestick is completely engulfed by the subsequent larger candlestick. The Engulfing pattern suggests a shift in market sentiment and often indicates a potential reversal of the prevailing trend.

Here are the key characteristics of the Engulfing candlestick pattern:

Bullish Engulfing Pattern:

The Bullish Engulfing pattern occurs during a downtrend and is characterized by a small bearish (downward) candlestick followed by a larger bullish (upward) candlestick. The bullish candlestick engulfs the entire range of the previous bearish candlestick, including both the body and shadows.

Bearish Engulfing Pattern:

The Bearish Engulfing pattern occurs during an uptrend and is characterized by a small bullish (upward) candlestick followed by a larger bearish (downward) candlestick. The bearish candlestick engulfs the entire range of the previous bullish candlestick.

Hammer:

The hammer candlestick pattern is a single candlestick pattern that is widely recognized in technical analysis. It is primarily considered a bullish reversal pattern and can provide valuable insights into potential trend changes. The hammer pattern is characterized by a small body located at the upper end of the trading range with a long lower shadow.

While price is considered the best indicator, there are statistical tools that have been built to help with our analysis. Tools like RSI, MACD, Moving Average, Stochastic, etc. We'll discuss these tools in our future articles.

It is also important to note that while price action analysis provides valuable insights, it is not a foolproof method for trading success. Like any other trading approach, it has its limitations. Price can be influenced by external factors such as economic data, geopolitical events, or unexpected news releases that can cause sudden and significant price movements. Therefore, risk management, proper trade sizing, and the use of appropriate stop-loss orders are essential to mitigate potential losses.

Comments